A credit card is a convenient way to draw funds from a bank in order to make a purchase. The credit card provider sends a monthly statement detailing your spending, and you repay them at the end of the month. You have the option of making a single payment or spreading out your payments across many months. In addition to the principal amount you borrowed, you will also be responsible for paying interest if you maintain a balance.

Payment in whole and on time every month means no interest for you. In such a situation, if your credit is good enough, opening a rewards credit card account might be beneficial. Each purchase you make with a rewards credit card earns you points, cash back, or frequent flier miles. Those with stellar credit histories have access to a wider variety of benefits, including lower interest rates, rewards percentages, and fees.

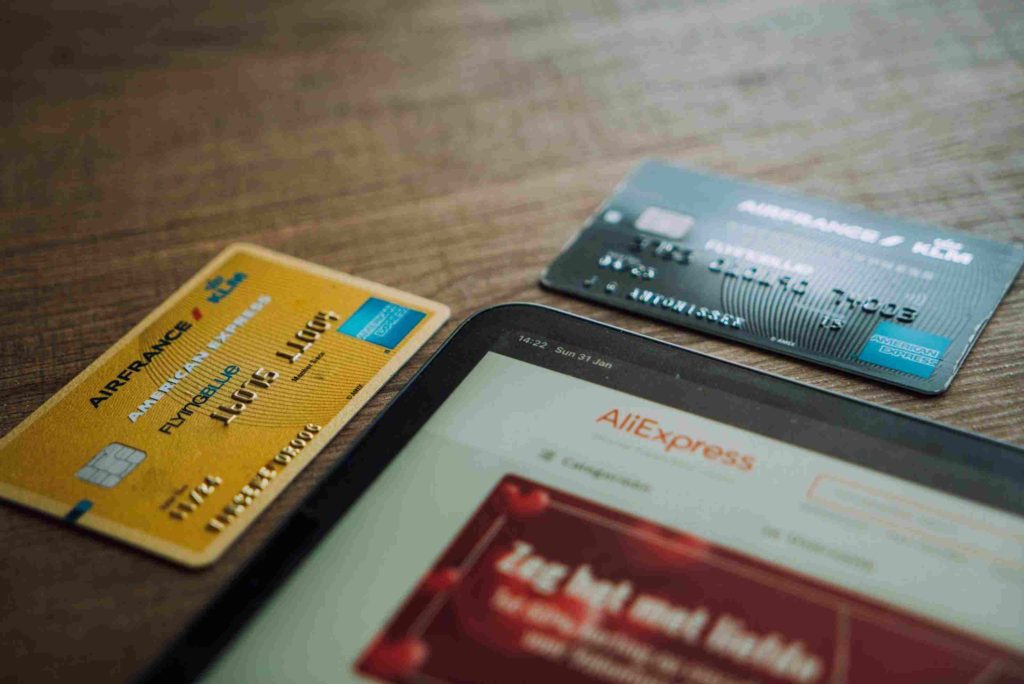

A financial institution is responsible for issuing your credit card. Your interest rate, fees, and incentives will all be set by the issuing bank, so shop around for the best deal. A payment network (like Visa, Mastercard, or American Express) handles all of the processing for you. Locations where the card may be used are determined by this network. Some credit card benefits, like insurance for rental cars or protection for cell phones, may come from the payment network instead of the bank that issued the card.

Table of Contents

Financing Costs and Interest

There are three main revenue streams for credit card companies:

- When you use a credit card, the store may charge you a transaction fee.

- When a debt is not paid in full, interest must be paid.

- Late fees, yearly fees, and other such charges.

There are many different types of costs associated with credit cards, such as yearly fees, fees for making cash advances, and late payment penalties. Be sure to make at least the required monthly payment on time to avoid being hit with a fine and a higher interest rate, which could have a negative impact on your credit score. Annual fees are rare except for cards that offer substantial rewards or are tailored to people with less-than-good credit.

The Annual Percentage Rate of Interest on Acquisitions

A credit card revolves around the fact that you can charge now and pay later. All balances from the prior month that were not paid in full will accrue interest at this rate. If your annual percentage rate (APR) is 15%, for example, you won’t be charged 15% all at once, but rather 0.041% per day. To encourage you to begin using your card, some issuers provide a 0% APR promotional period that might last for six months or more. Take advantage of these deals to make a sizable purchase and spread out the cost of the repayment over a longer period of time with zero interest.

Cost of borrowing to Pay off Debt through a Balance Transfer

Balance transfers allow people with existing credit card debt to move their debt to a new credit card account. In certain cases, you may transfer your debt to a new credit card and avoid paying interest for a set amount of time, often as long as a year. However, in other cases, the interest rate will be the same as for new purchases.

There is often a one-time debt transfer fee that is a certain percentage of the amount being transferred. Here are some of the other charges you may incur when using a credit card:

- Annual Percentage Rate Penalty, as explained here

- Missed payments may result in a six-month increased interest rate.

- Annual Cost for the card/account

While annual fees aren’t typical, you can find them on cards with generous rewards. Cards for those with mediocre or low credit may contain fees.

Balance Transfer Penalties

When you transfer a balance from one credit card to another, the new card issuer will often charge you a balance transfer fee. There will be a fee deducted from the total amount sent, normally between 3% and 5%. For certain cards, the transfer is free.

You will be charged a cash advance fee in addition to the interest that accrues from the moment you get the cash.

All purchases made with your credit card in a foreign nation will incur a foreign transaction fee. Costs associated with making a purchase in a foreign currency average 3 percent of the total. However, certain issuers do not impose this fee on any of their cards, and the vast majority of travel-specific credit cards do not either.

Costs of infractions/over limits/missed payments.

A charge is assessed if your credit card payment is late by more than the minimum payment due date shown on your monthly statement. It is possible for your credit ratings to be impacted if you are overdue by more than 30 days. Missed payments are another fee. When a customer makes a purchase that causes them to go over their credit limit, the card issuer may still accept the purchase but impose an over-the-limit fee. Over-limit protection is available, but only if you specifically request it. That’s why it’s unusual to incur costs for going above your credit limit.

When you’re just Getting Started Credit Card

Good to exceptional credit is required to get approved for the finest credit cards. Those who have never had credit before will need to establish it as a prerequisite to other financial endeavors. One possible course of action is to apply for a secured credit card.

With a secured credit card, you must put down a cash deposit equivalent to your credit limit. The card issuer is protected by the deposit. Credit card (https://en.wikipedia.org/wiki/Credit_card) issuers are more likely to provide secured cards to those with low or nonexistent credit scores since the deposit mitigates risk for the issuer. However, you will still be required to provide proof of income at the time of application.

Second Option

A second option is to apply for a student credit card. Credit cards aimed towards students are tailored to the needs of young people with limited credit histories. Being enrolled in an educational institution is not automatically sufficient to get a student credit account. You’ll need proof of independent income if you’re under 21 years old and also proof of residence, in addition to income records for a period of time. Once you turn 21, you are required to record all sources of income, including those from a spouse or parents.

Third Option

As a third alternative, you may register as a valid user. When someone is permitted to use another person’s credit card, they are effectively using the card without their owner’s knowledge or permission. Your own personal credit card is issued to you. However, you are not obligated to make payments; rather, the principal cardholder is. Authorized user activity is often reported to the credit agencies by many issuers, which may have a positive effect on your score.

Alternative four is to look for a co-signer. Somebody who guarantees that they will pay your obligations on your behalf is called a co-signer. It’s usually a family member or close friend. A co-signer may be required by certain issuers while others do not.